Introducing: Mach

Dear community,

To date, we've supported $5 million in trades across ~1600 transactions in Hourglass, with trade caps of $25,000. Our traders have provided invaluable insight on our product development, and we're thrilled to unveil the newest evolution of our protocol.

Welcome to Mach.

Mach is a new DeFi primitive that facilitates swaps between assets on any two chains. It’s extremely fast, cheap, and safe: our new optimistic escrow system enables instant (one block) settlement and over a 95% slash in our gas fees, without compromising user security.

Why does this matter?

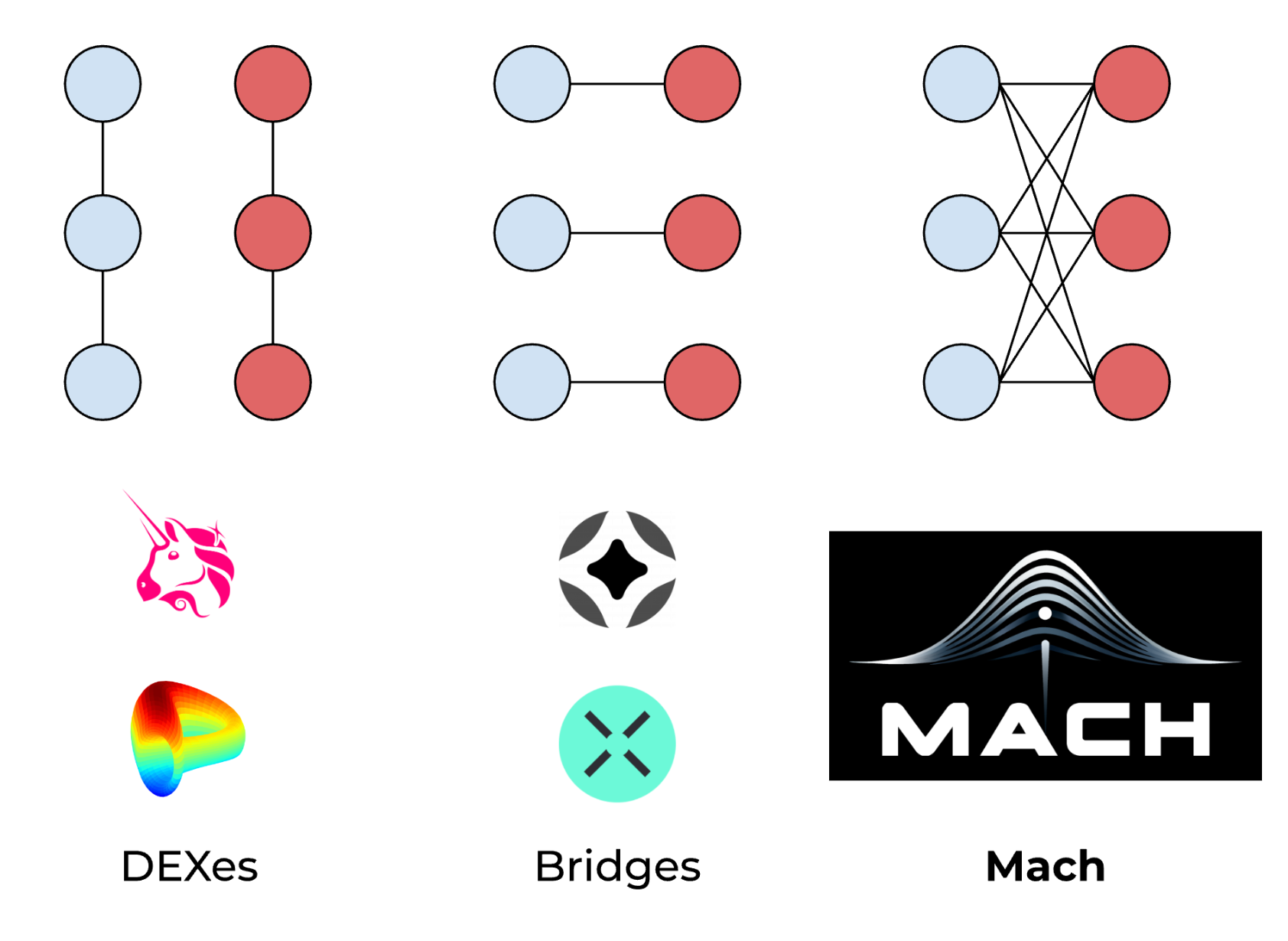

Moving capital in DeFi today is far too difficult. Users have to navigate a complex maze of DEXs, bridges, and intermediary chains just to swap assets. This is tedious, risky, and expensive.

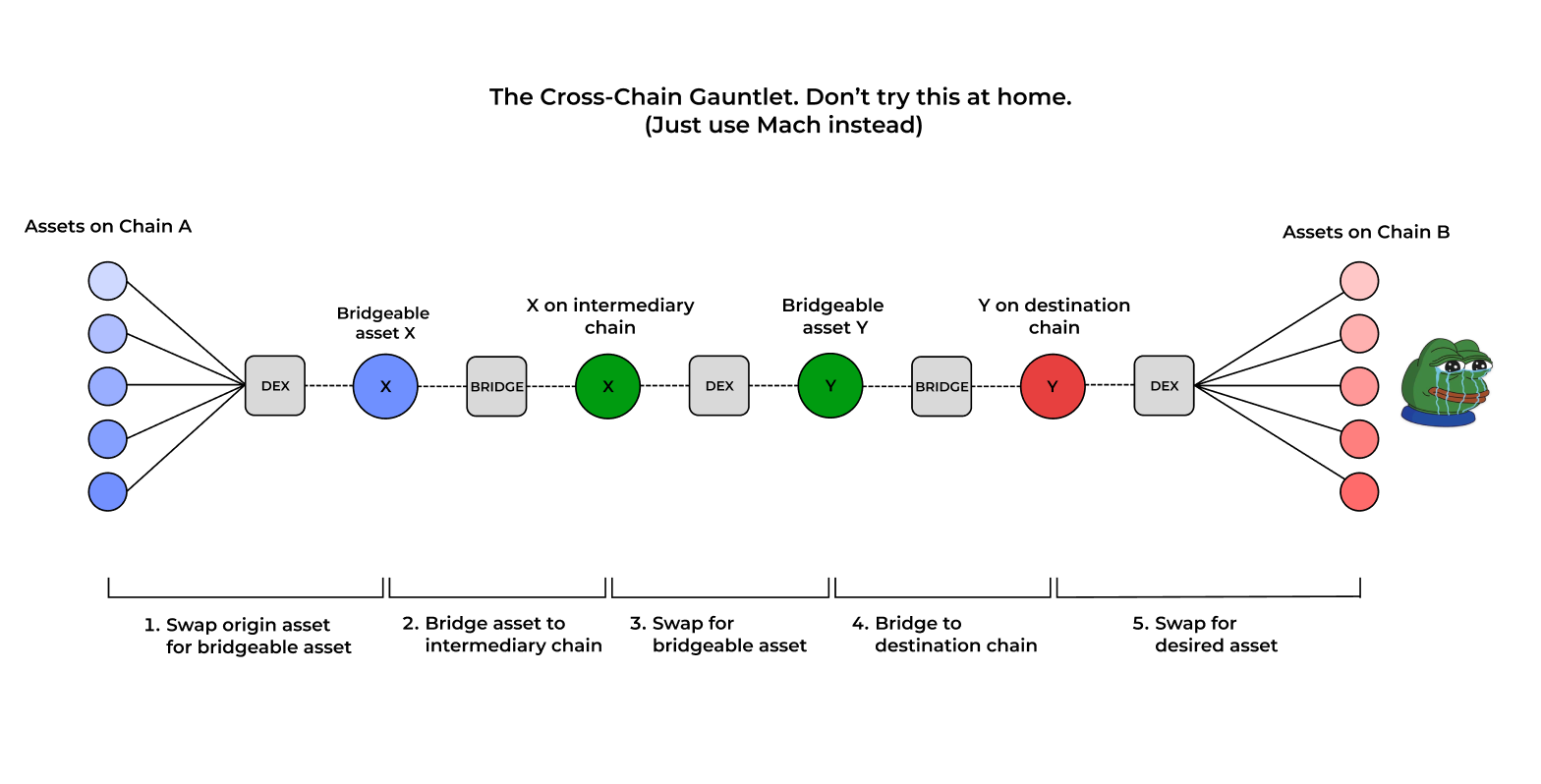

One major pain point is that all cross-chain swaps must flow through a limited number of “bridgeable” assets like USDC or Ethereum. In particularly nightmarish scenarios, there are zero common bridgeable assets between two chains… meaning you need to move money through an intermediary chain. See below:

A more common (but still frustrating) trade flow is:

- Swap origin asset for bridgeable asset X

- Bridge using asset X to destination chain

- Swap asset X for desired final asset

All steps above incur costs, delays, and counterparty risk.

With Mach, all of these steps are reduced to one. Mach gets you what you want, when you want it, no matter what chain or asset you start with.

Under the Hood:

Mach’s order matching and optimistic escrow protocol together form a universal virtual order book that allows trustless cross-chain settlement of user intents. Because it is optimistic, cross-chain communication is only needed to challenge "bad" actions, allowing for trades to be cleared instantly and cheaply—95% cheaper and 99% faster than its predecessor Hourglass.

Mach offers:

1. Instant settlement (single block).

2. Lowest transaction cost. Transactions costs are an order of magnitude lower than every other system: each trade only involves writing 512 bits.

3. Maximized integrability. Because we work with any communication standard, we can support more chains more quickly than other solutions.

Below we provide a closer look at Mach’s most notable characteristics.

Optimistic Escrow

At its core, what makes Mach superior to any other system for cross chain swaps is its optimistic escrow logic. 99.9% of the time, the solver will simply send the user the desired funds instantly. Because Mach only invokes cross-chain communication when a “bad” or incorrect action occurs, it significantly reduces gas costs and settlement speeds. We’ll publish a deeper look at our optimistic system soon.

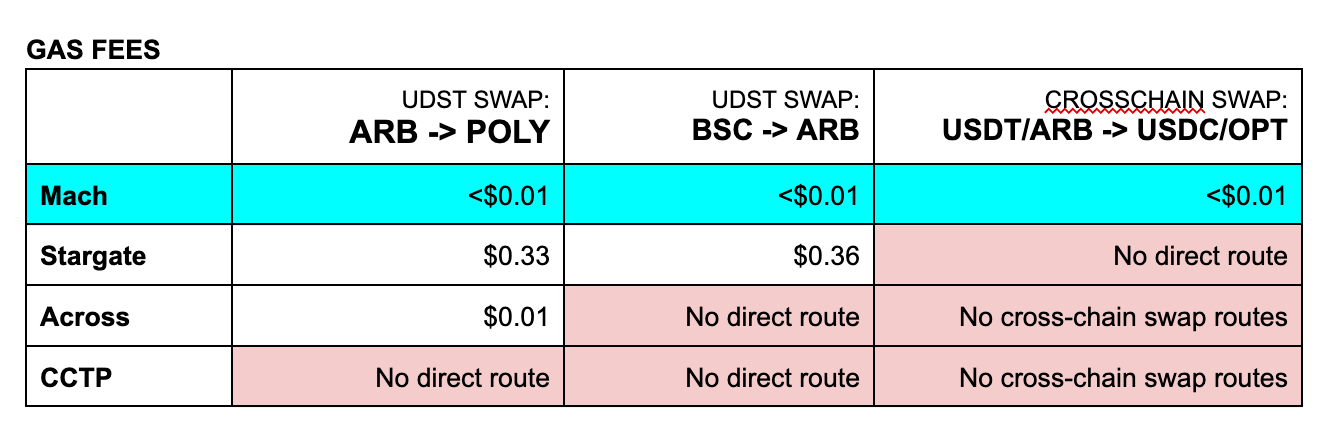

Gas efficiency

Mach is highly gas efficient. The only information we are writing onchain is a limit order, which is quite small (~512 bits). Most transactions will cost less than a cent in gas fees. This is an order of magnitude less expensive than other cross-chain routes today (most of which are done through aggregators, or manual multi-step processes).

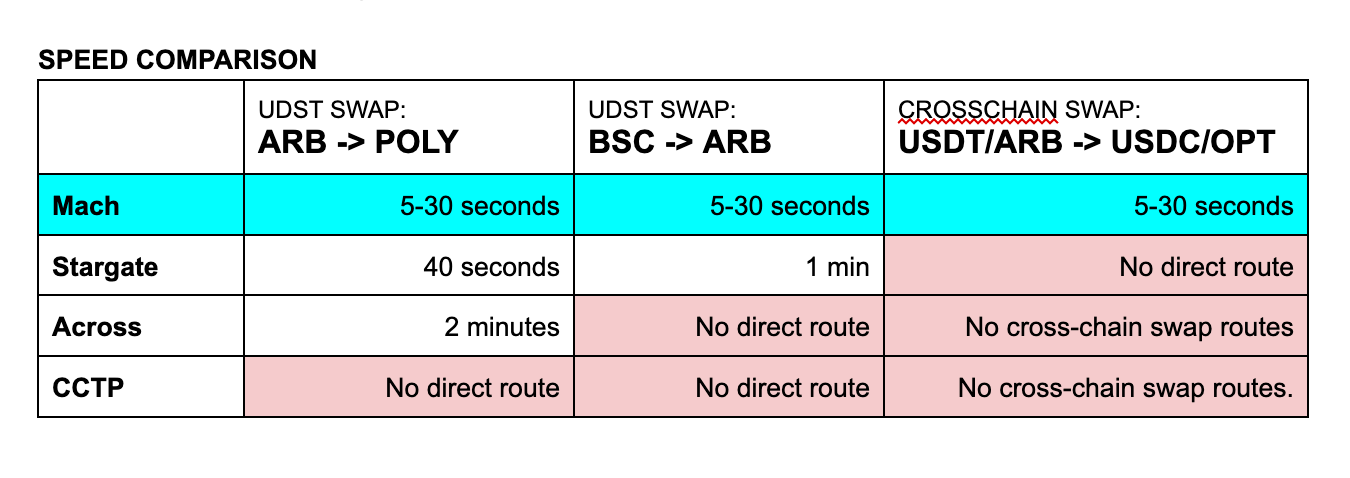

Speed

Trades on Mach 2 are settled within one block—as fast as the blockchain allows us! Mach is not constrained by the speed of cross chain bridges for settlement; it is limited only by risk that market makers are willing to run. (It can be argued that we are offloading the problem of pricing risk, which is valid!)

Capital Efficiency

Mach is highly capital efficient. The proper way of measuring capital efficiency is comparing dollar/hours to theoretical maximum volume. The core protocol only requires both legs of the trade for a single block which is optimal. The collateral and its management is the only source of inefficiency in this system. The length of the challenge window directly determines the protocol's capital efficiency.

It is difficult to directly compare systems as capital efficiency ends up a byproduct of how systems are used, but we expect Mach, even with reasonably long challenge windows, to outperform every system in production today and intend to publish reports examining this once we have more data.

Mach vs. Aggregators

Aggregators are an essential part of DeFi. They’ve improved the DeFi liquidity experience immensely and we view our relationship with them as symbiotic. One important touch point here is the fact that our market makers can use any liquidity source they’d like, including aggregators. We don’t care where they source liquidity, because our users don’t care! Opening up liquidity to sources outside of DeFi improves the depth, pricing, and speed that our users experience.

This brings us to the core of our user experience, and where we differ from aggregators. Aggregators “propose” a series of transactions for a user to sign, which ultimately execute the user's intent. In contrast, Mach users sign only one transaction, and either receive their desired assets instantly or get their money back. Risk and operational complexity is borne by our market makers; users have their intents filled with minimal effort from their side.

Scaling Mach

Mach is essentially a market, and our long term vision is for Mach to serve as the connective tissue between any and all ledgers. Our primary goals to achieve this are twofold:

1. Exponentially increase our number of direct routes by continually adding support for new chains and new assets.

2. Mirroring CeFi speeds and liquidity within our system.

Mach was built with these goals in mind. Our code is lightweight and flexible, and can support any messaging service, so we can onboard new chains rapidly. Our team is deeply involved in sourcing liquidity, so we can directly and cheaply convert engineering hours into increased reach and asset support. We are very confident that we will be able to mirror Binance's liquidity within Mach, which is measurably and considerably superior to any DeFi system operating today.

Chains rolling out with V2: Ethereum, Arbitrum, Avalanche, Polygon, Binance Smart Chain, Optimism, Base, Celo, Tron, OpBNB, Scroll, Mode, Blast

Currently exploring: Worldchain, Berachain, Fantom, Mantle, Ronin, Monad, Linea, Sea

Developers

Mach is for you, too :-) Fragmented liquidity and the friction of moving money between native assets make it far too difficult to onboard new users. We are building a more connected world of crypto where users flow between ecosystems easily.

Think of us like Stripe for crypto. Mach allows you to onboard users holding any asset on any chain. Reach out if you’d like to work with us.

Points Season 2

Season 1 of our Points Program is still live, rewarding points for any swaps placed on app.mach.exchange! We’ll be launching Season 2 next week with some fancier features, but we’re currently rewarding our earliest adopters. 👀

Join the community

- Telegram: https://t.me/hourglassmoney

- Discord: https://discord.gg/db3yn5mZUp

- Twitter: https://twitter.com/machfinance